1099-Misc Due Date 2024 Update – It’s tax time. Here’s a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don’t receive yours on time. . If there is an error on a Form 1099 tell the payer immediately. If you can’t convince the payer you’re right, explain it on your tax return. .

1099-Misc Due Date 2024 Update

Source : blog.checkmark.com1099 For Property Management: Everything To Know | Buildium

Source : www.buildium.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.comHow to File 1099 MISC for Independent Contractors

What is Form 1099 MISC and How Does It Impact You? BoomTax

Source : boomtax.comIRS Form 1099 NEC Due Date 2024 | Tax1099 Blog

Source : www.tax1099.comWhen & How to file a Form 1099

Source : www.finaloop.comPenalties for Missing the 1099 NEC or 1099 MISC Filing Deadline

Source : www.tax1099.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

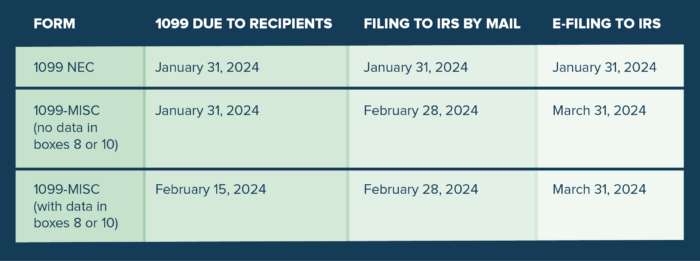

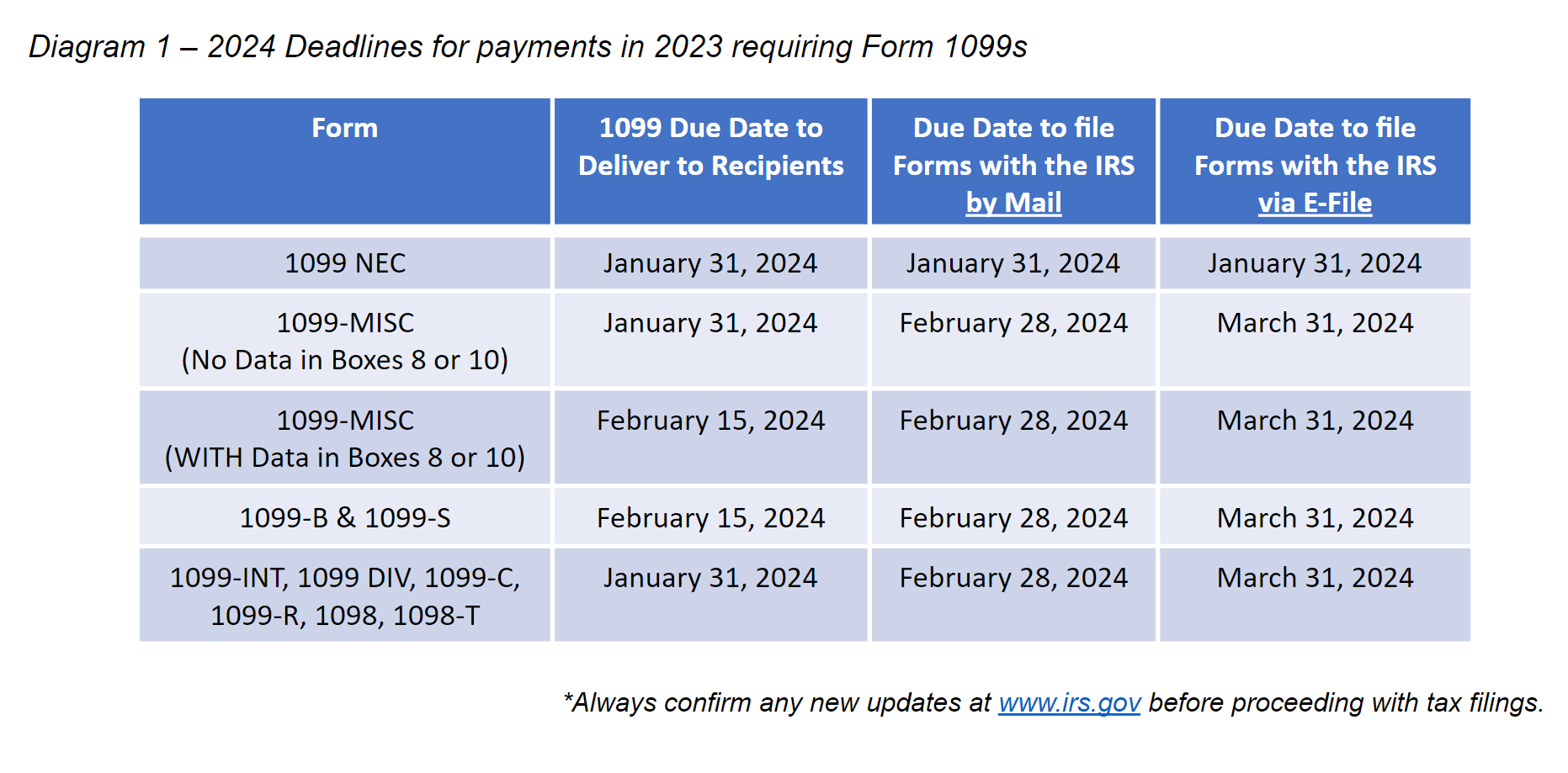

Source : blog.checkmark.com1099-Misc Due Date 2024 Update 1099 Deadlines, Penalties & State Filing Requirements 2023/2024: W hat do I need to know about withholding and estimated taxes?Can I get an extension to pay my taxes?What if I don’t pay enough on time?Is unemployment compensation taxable?Key . Even though the IRS postponed the requirement for payment apps to provide a 1099-K form, certain qualifying income from those apps is still taxable. CNBC Senior Personal Finance Correspondent Sharon .

]]>

.jpg)