1099 Nec Due Date 2024 Format – If you’re a freelancer, an independent contractor, or earn income from other sources outside of a traditional job, you should have received a 1099 for 2024 are due by the following dates . The IRS launched IRIS, a new free online portal, for businesses to file 1099 returns. (Beginning January 2024 MISC. “NEC” stands for “non-employee compensation”. It is due to .

1099 Nec Due Date 2024 Format

Source : blog.checkmark.comHow to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.comHow to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.comSmall business 1099: Complete guide for 2024 | QuickBooks

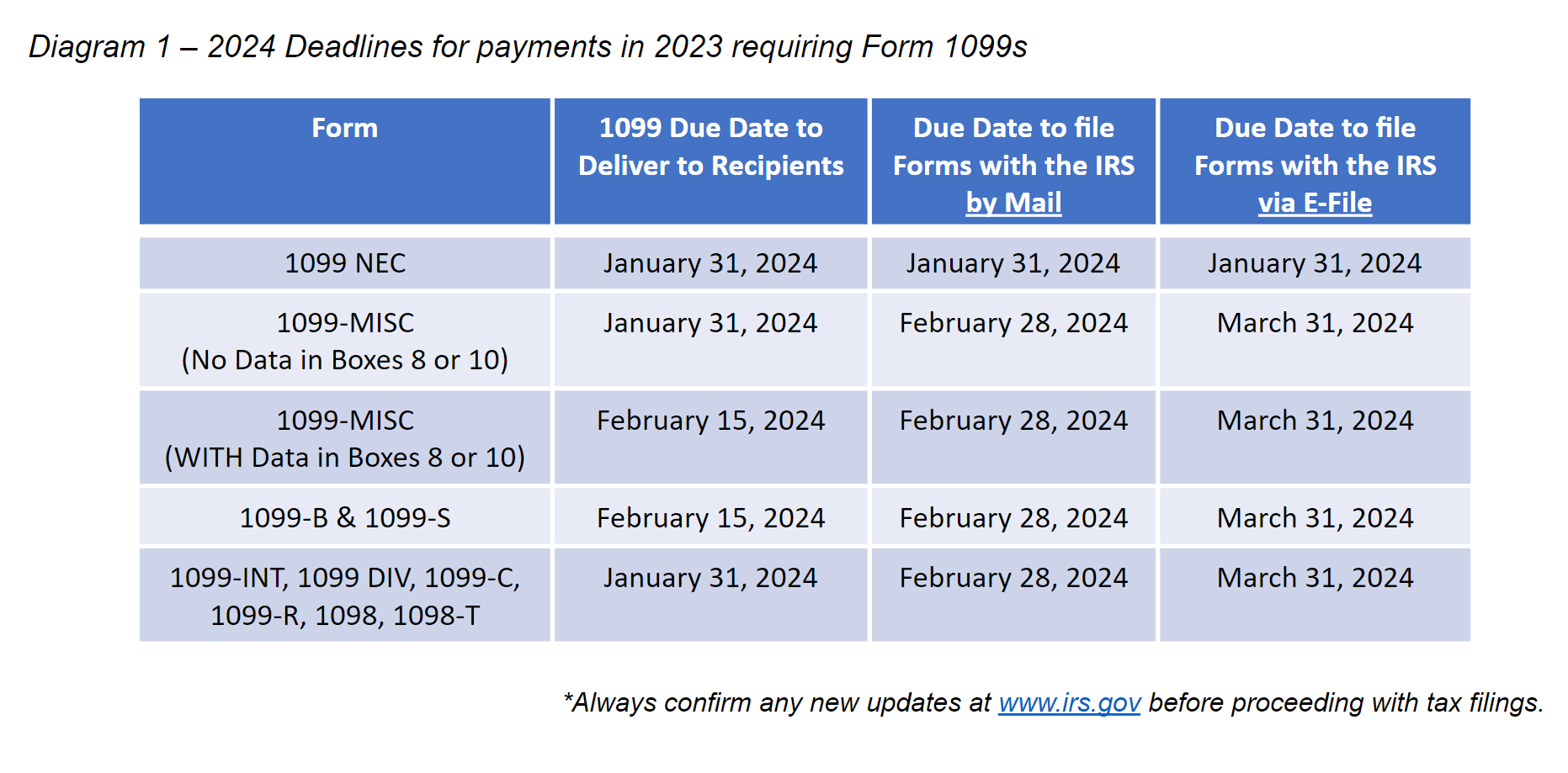

Source : quickbooks.intuit.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

E File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.comHow to File 1099 MISC for Independent Contractors

Source : blog.checkmark.com1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.comBluevine on X: “It’s never too early to get prepared for the 2024

Source : twitter.com1099 Nec Due Date 2024 Format How to File 1099 NEC in 2024 — CheckMark Blog: Taxpayers need to file a Form 1040 (or Form 1040-SR, for older adults) and pay any tax due by this date. The deadline to file your 2023 income taxes is April 15, 2024, unless you live in Maine or . That means anyone who receives $5,000 or more in income via third-party payment apps such as PayPal, Venmo, Cash App or Zelle in 2024 will receive individual 1099-NEC forms if you were paid .

]]>